Crop insurance is the largest farm program in the Farm Bill and is both a major tool for farm-level risk management as well as a significant subsidy program. There are calls for reductions in crop insurance program spending, and other legislators and producer groups are working hard to defend the program and grow it in strategic ways.

This article provides an overview of Oregon’s participation and experience with the federal crop insurance program over the last 10 years. The figures and statistics are summarized from publicly available USDA-RMA Summary of Business (SOB) data.

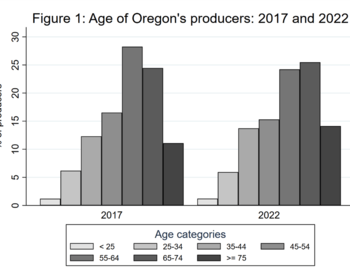

Farmer participation in the crop insurance program depends heavily on the farm’s crop mix and where they are located, with specialty crop producers much less likely to participate than producers of the largest commodity crops.

One way to think about Oregon’s “return” from the crop insurance program is to look at the total amount received by Oregon farmers net of their insurance premiums.

Figure 1 below shows the difference between the amount that Oregon farmers received from the crop insurance program in indemnity payments and the amount that they paid into the program in premiums over the past 10 years. The last three years, and 2021 in particular, had large crop losses and high indemnity payments, but in most of the last decade the state’s farmers netted between $10 and $30 million from the crop insurance program.

The average "return" from crop insurance to Oregon is roughly $48 million per year, which is much lower compared to states that are stronger in crops with higher crop insurance participation rates.

Figure 2 shows Oregon’s 10-year average annual net subsidy compared to those received by the 10 largest recipient states. The list is dominated by states producing major commodity crops, with California making the top 10 because of the scale of their agriculture industry rather than particularly high rates of participation in insurance programs.

Though crop insurance plays less of a role in Oregon than in many other states, many Oregon farms benefit from the risk management provided by the program. Figure 3 shows the liabilities by crop for Oregon in 2022. This number is the total crop value insured. The top two crops are wheat, along with pasture/rangeland/forage.

For producers of crops that are not insurable on an individual basis, or diversified farms for whom it would be cumbersome to insurance all crops separately, whole-farm revenue protection can be a viable option, and the product had more than $50 million in liability in 2022.