Benefits of good farm financial planning

Like any other farm business, a farm-direct marketing operation can greatly benefit from good financial management and planning. Farm financial planning is a necessary step in any of the following situations:

• Applying for a loan

• Making an informed decision on an investment or expansion

• Developing and achieving short- and long-term performance/profitability goals

• Protecting the operation’s assets

• Organizing the distribution of funds for personal use

Without a thorough understanding of the farm’s finances, it is very difficult for a farm business to determine which enterprises are more and less profitable. More specifically, without good financial planning and evaluation, the farm operator has little more than intuition to guide important decisions about the future of the farm.

Direct-marketing businesses often have several distinct sources of revenue and many enterprises, so some aspects of financial analysis and planning might be more complicated for them than for larger but less complex farms. For that reason, financial planning is especially important for direct-marketing businesses. This guide will help prepare farm managers to develop and use basic farm financial planning tools to set goals and achieve them.

Some important terms

Financial planning often involves specialized terms. Most describe concepts and activities that are already familiar to farm managers and should not be intimidating. The following words and phrases will be helpful in developing (and understanding) financial statements and plans for your farm business.

• Equity capital (or ownership capital) is money from savings, gifts, or other sources that is not borrowed. This is the money that the farm operator brings to the business.

• Debt capital is money borrowed from lenders.

• External capital comes from outside the business, primarily through equity and debt. Internal capital comes from inside the business, through the sale of farm products.

• Financial planning works to determine how much capital or money you need, when you will need it, and how you will acquire it. Planning also includes developing a business strategy to achieve long-term operating objectives such as survival, growth, and profits.

• Cash management is budgeting for the future flow of cash receipts and disbursements in order to meet obligations when due. This involves forecasting sales, margins, expenses, and, ultimately, profits.

• Financial control involves checking, evaluating, and measuring your business’s financial progress and enables you to take corrective action when actual results differ from what you planned.

• Risk management encompasses protecting business assets and capital from production and marketing risk, appropriate estate planning, maintaining adequate business and liability insurance, the legal organization of the business (e.g. corporation, partnership, limited liability company [LLC]), diversification, and adequate training of employees.

• Profit is the return for the time, effort, and money you invest in the business and is your reward for accepting the risk of possible losses. Some farm-direct marketers define profit as “something left over at the end of the year—if I am lucky.” This attitude spells the beginning of the end for many operations, and indeed they will be lucky if any profits remain. While profits are never guaranteed, they are more likely to materialize when you plan to earn them.

Keys to success in financial planning and management

While financial statements and projections are often interesting in their own right, they are most useful in helping to guide the farm operation towards a specific goal or objective. For example, an objective might be to earn a 25 percent annual rate of return on equity capital. Another possible (and more common) objective would be to cover all costs and generate profits sufficient to meet reasonable living expenses. It is important that farm business objectives be in writing and that they specify clear, measurable outcomes. The objectives are only useful if they are realistic, attainable, and understandable by all involved in the operation and management of the business.

Once you establish a goal or set of goals, then develop an action plan to meet those goals. An action plan describes, step by step, how the business will achieve specific results within a stated time. In planning for sales, profits, and returns on investments, it is important to give close attention to pricing and marketing as well as control of inventory and expenses. When creating a plan, consider the following steps:

• Compare the operation to its competitors. What advantages does your business have over other, similar operations?

• Forecast sales for the coming year and how they might change over time, either because of changes in market demand, competitors’ actions, or changes in the operation itself.

• Budget and plan for sales, margins, and expenses.

• As progress is made, evaluate the operation’s results and compare them to the established objectives.

• Adjust the plan as needed.

Financial records

At a minimum, all businesses should prepare a balance sheet, an income statement, and a cash-flow statement. A farm-direct marketing operation is no exception, regardless of size. The income statement shows the operation’s revenues and expenses for a particular period. The balance sheet indicates what the business owns and what it owes at a particular time. The cash-flow statement summarizes all cash inflows and outflows over time and can show when cash might be available and when to expect cash deficits. These three financial statements help you answer such questions as:

• What is my present financial status?

• What factors have caused my business to be in this condition?

• How does my financial condition compare to similar operations?

As much as possible, the operation’s financial records should be kept separate from other business and personal financial activities, including off-farm income. This allows you to analyze your direct-marketing operation(s) more clearly. Although there are several software options to keep track of farm accounting records and produce sophisticated reports, starting out with a program like Microsoft Excel to record income and expense transactions is often a good way to begin building useful financial records and statements.

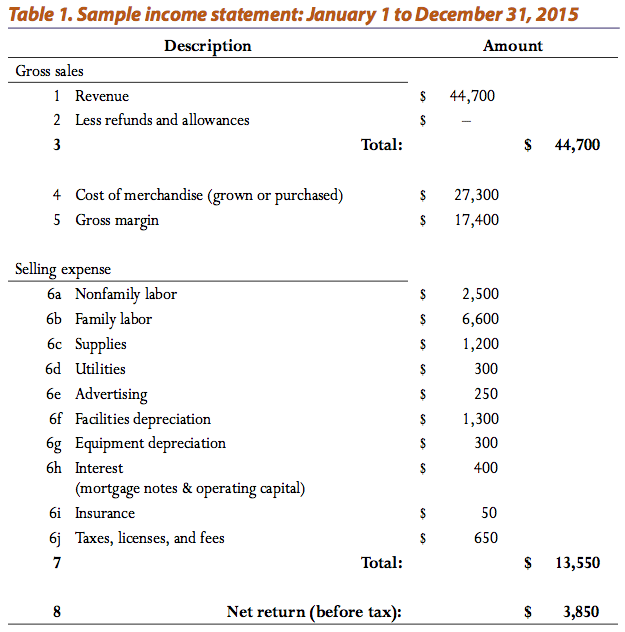

Table 1 presents a sample income statement. The income statement includes the farm’s revenues and expenses and shows the total amount of net farm income (or loss) earned during the year. Farm revenue should include all of the final crop or livestock products that are sold to customers as well as other forms of income like government payments, insurance claims, and custom work or other services performed for other farms. It is also important to include all farm expenses, including facilities and equipment depreciation, interest on outstanding debt, and the value of family-supplied labor.

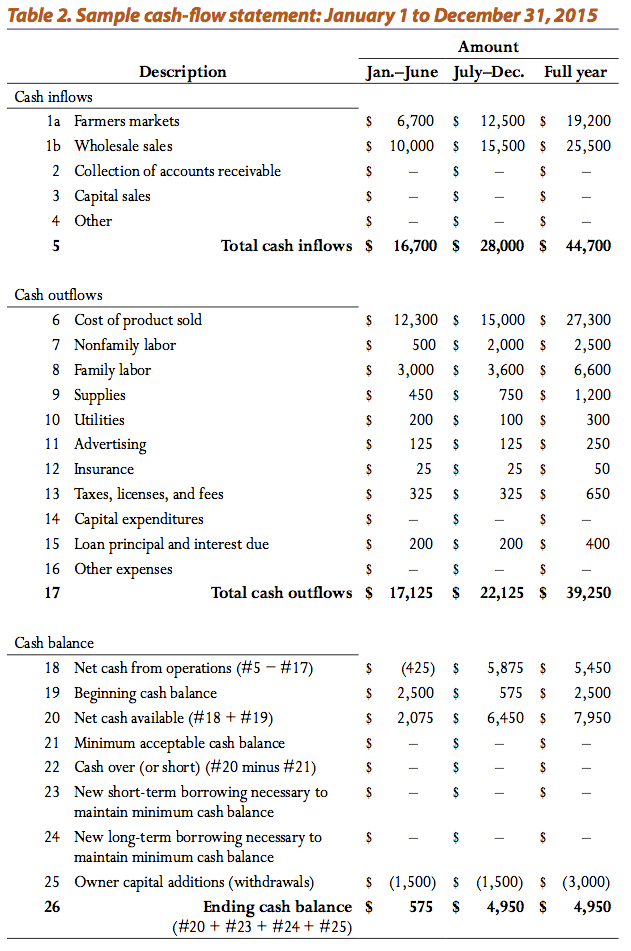

Table 2 presents a sample cash-flow statement. The cash-flow statement summarizes all cash inflows and outflows over a specific period. It identifies the sources, amounts, and timing of cash income and expenses. Unlike an income statement, the cash-flow statement ignores income and expense categories that do not directly impact cash balances, such as equipment depreciation and write-offs of unrecoverable debt. It can show the business manager when excess cash might be available and when to expect cash deficits. This statement is particularly helpful in planning for short-term borrowing and irregular cash expenditures.

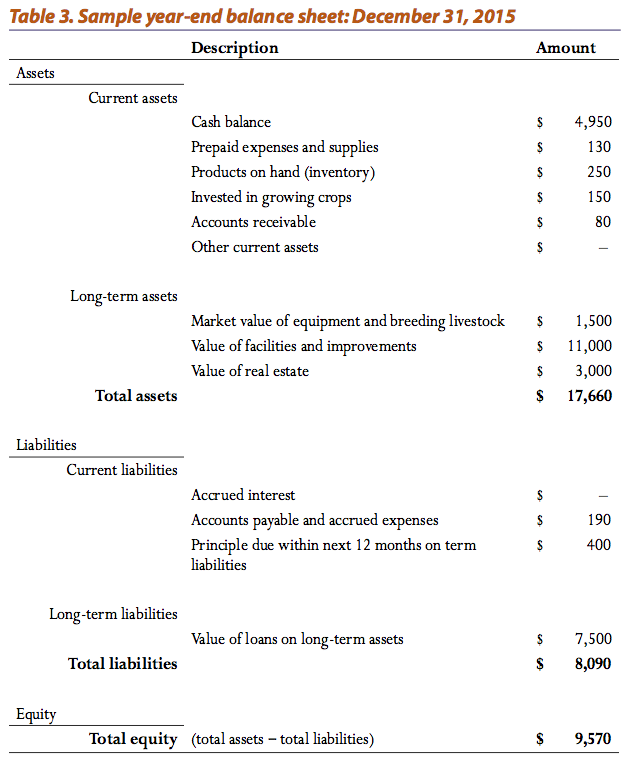

Table 3 presents a sample balance sheet. The balance sheet shows what the business owns, what it owes, and the amount of equity that the owners have in the business. Unlike the income statement and the cash-flow statement, the balance sheet does not cover a period of time but is rather a snapshot of the operation’s assets and liabilities. The balance sheet will reflect changes in inventory and equipment values that the other statements will not.

Evaluating performance

In addition to helping a farm business plan for the future, financial records and statements can also play a vital role in evaluating the farm’s past and current performance. Farms that include multiple direct-marketing enterprises, such as farmers markets, community-supported agriculture, or a farm stand, should seek to analyze these different marketing channels separately to understand how each contributes to the profitability of the farm. This topic is discussed in Farm-direct Marketing: An Overview and Introduction(PNW 201).

There are several commonly used financial measures to examine the overall performance of the farm. Each is used for a different purpose. This section will explain how to calculate and use these measures.

Liquidity

Working Capital = current assets – current liabilities

Current Ratio = current assets ÷ current liabilities

These liquidity measures indicate how easily a farm business can cover debts if they were to liquidate current assets. Current assets are things such as cash, and accounts receivable and inventory that will soon be converted to cash. Current liabilities are debts that are due within a year.

Solvency

Debt-to-Asset Ratio = total liabilities ÷ total assets

Equity-to-Asset Ratio = total equity ÷ total assets

Debt-to-Equity Ratio = total liabilities ÷ total equity

These solvency or leverage measures help assess whether a business is at risk of being unable to meet loan payments. Total liabilities are the aggregate debt and financial obligations owed by a business to individuals and organizations at a specific time. Total assets are defined as anything that a business owns, that has value and can be converted to cash. Total equity is defined as the firm’s total assets minus its total liabilities. Lenders often use these measures to evaluate the riskiness of a loan. Debt-to-asset ratios on farms are often around 30 to 40 percent, but vary widely by the type and circumstances of the farm. It is important to compare your farm’s performance measures with those of similar farms.

Profitability

Return on Assets (ROA) = net income (during period) ÷ total assets (at end of period)

Return on Equity (ROE) = net income (during period) ÷ equity (at end of period)

Gross Margin Percentage = (net sales – cost of merchandise sold) ÷ net sales

Profitability measures serve as important indicators of a farm business’s performance. Except in exceptional circumstances, a business needs to earn profits to continue in operation. As a side note, positive cash flow, even for an extended period, does not mean that a business is profitable. The three rates-of-return measures above should be used to compare not only to the rates of return achieved by other similar farm operations but also to other investment options. If, for example, investing farm equity in a savings account could consistently make more money, changes to the farm business might be in order.

The Farm-direct Marketing Set

A farm-direct marketing business provides both attractive opportunities and unique challenges to farm families. The farm-direct marketing series of Extension publications offers information about establishing and developing a range of farm-direct enterprises.

Other publications in the series are:

• An Overview and Introduction (PNW 201)

• Costs and Enterprise Selection (PNW 202)

• Merchandising and Pricing Strategies (PNW 203)

• Location and Facilities for On-farm Sales (PNW 204)

• Personnel Management (PNW 205)

• Legal Guide to Farm-direct Marketing (PNW 680)

• Food Safety and Product Quality (PNW 687)

To learn more, consider one of the online courses offered by Oregon State University, Washington State University, and University of Idaho:

In Oregon—Growing Farms: Successful Whole Farm Management https://pace.oregonstate.edu/catalog/growing-farms-successful-whole-far…

In Washington—Cultivating Success™ Sustainable Small Farms Education Program: http://cultivatingsuccess.wsu.edu

In Idaho—Cultivating Success™ Sustainable Small Farms Education Program: www.cultivatingsuccess.org

This information is provided for educational purposes only. If you need legal [or tax] advice, please consult a qualified legal [or tax] adviser.

Trade-name products and services are mentioned as illustrations only. This does not mean that the Oregon State University Extension Service either endorses these products and services or intends to discriminate against products and services not mentioned.

© 2018 Oregon State University.

Extension work is a cooperative program of Oregon State University, the U.S. Department of Agriculture, and Oregon counties. Oregon State University Extension Service offers educational programs, activities, and materials without discrimination on the basis of race, color, national origin, religion, sex, gender identity (including gender expression), sexual orientation, disability, age, marital status, familial/parental status, income derived from a public assistance program, political beliefs, genetic information, veteran’s status, reprisal or retaliation for prior civil rights activity. (Not all prohibited bases apply to all programs.) Oregon State University Extension Service is an AA/EOE/Veterans/Disabled.