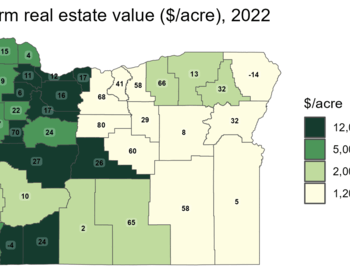

Property is generally valued and taxed based on real market value or what that property would sell for in the real estate marketplace. Oregon’s property tax system has some different twists and turns. The Oregon Legislature established several special assessment programs that help reduce property taxes for forestland owners who manage their property primarily for the purpose of growing and harvesting trees. Join us and learn a little more about how Oregon’s property tax system works. What is the difference between real market value and assessed value? Which forestland programs are available to you and how is forestland valued? Learn how to apply for programs, what property qualifies, and how to reduce your taxes. Bring the questions you’ve always wanted to ask and we will provide answers.

Originally aired on May 5, 2020

Instructors:

- Lynn Longfellow, Clackamas County Appraisal Manager

- Tony Hunter, Clackamas County Senior Appraiser

- Bronson Rueda, Clackamas County Deputy Assessor

Resources: